Yoguely is reader-supported. When you buy through links on our site, we may earn an affiliate commission. Learn more

Why Helicopter Money Is Inflationary

Today you’ll learn which of the Fed’s “Money Printers” is most inflationary: Helicopter Money or Quantitative Easing.

In this guide, you’ll see:

How has the money supply changed over time in the USA.

How much helicopter money has the USA distributed over the years.

What is the value of total assets purchased by the Fed.

Let’s get right into the data!

Money Supply in United States Today

To figure out which of the Fed’s “Money Printers” causes the most inflation, we will need to know how much cash has gone into circulation. So you’ll need to figure out:

what is the money supply in the United States today?

To find this, just go to one of my favorite websites for economic data, and a prime source for many investors and traders, the Federal Reserve Bank of St. Louis.

What is the M2 Money Supply?

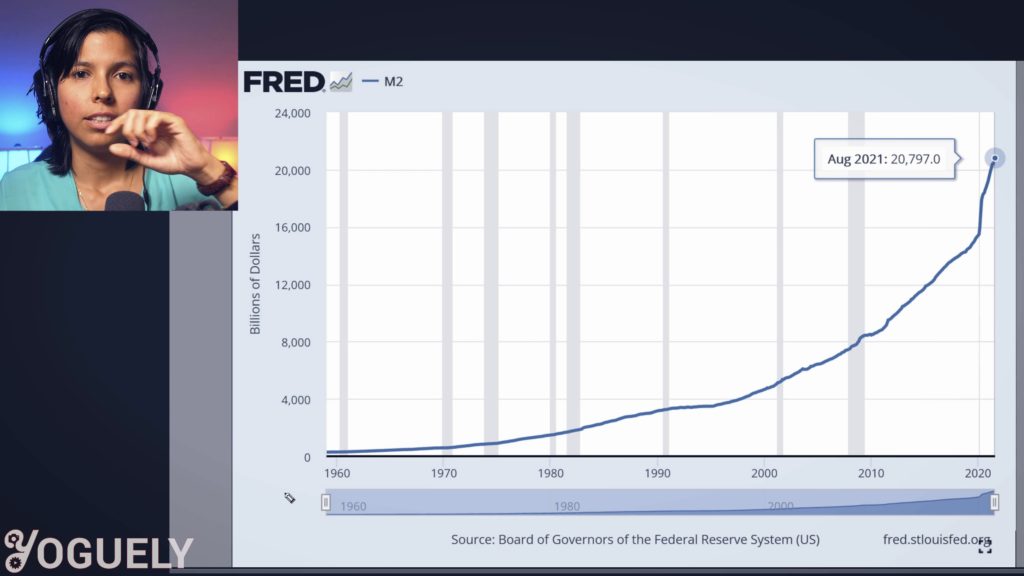

So this is the chart of M2 money stock which measures the money supply that is in savings deposits and the money located in funds that are easily convertible to cash such as money market funds.

The X-axis shows the years from 1960 to 2021, and the Y-axis shows the amount of cash in billions of dollars. As we can see it has been going up slow and steadily in the past and recently is has took off almost exponentially. Since 1959, the money supply has gone up over 7000%.

And since the year 2020, the Fed managed to increase the money supply in savings deposits and money market funds by 34%. So that $100 bill you were holding can only purchase $74 worth of stuff. Your purchasing power got crushed by the Fed’s printing press, or more like the push of a button.

The Federal Reserve has many tools for Monetary policy, i.e. “printing” more money. And boy did they use all the tools they could in 2020. But today we’ll go over 2 of them: Helicopter Money, and Quantitative Easing.

Helicopter Money

During the past year, the government forced certain sectors to stop operating, which caused an economic slowdown. To remediate this, the Fed pushed interest rates down and currently near 0%.

Yet the Fed wanted to provide even more even more monetary inflation to stimulate spending and hence restart economic activity. So, to continue to mitigate the economic impact of the closures, the government distributed helicopter money.

What is helicopter money?

Helicopter money when central banks simply created money out of thin air and directly handed it over to the population. Kind of like an air-drop. This is the second tool, other than pushing interest rates down, that they used to increase the money supply.

Helicopter Money Chart

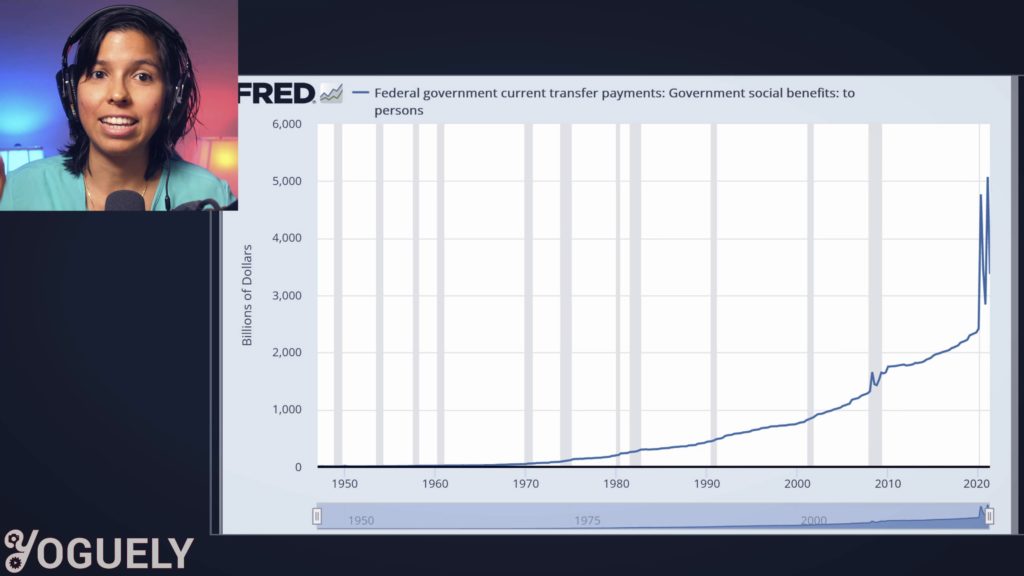

You can see the history of the helicopter money distributed to people here, in this chart of Federal government current transfer payments to people. In the X-Axis we got the timeline from 1950’s to now, and in the Y-Axis the amount of cash in billions of dollars.

First thing to note is that the amount of cash has been steadily increasing every quarter over the past 70 years. And this makes sense because this money is for things like unemployment benefits which needs to increase to keep pace with inflation. Benefits back in the day would not be enough to afford the same things today.

Secondly, in the global financial crisis of 2008 there was a bit more helicopter money than ordinary.

Last thing I’d like you to note is that in 2020 the helicopter money really spiked. Zooming in, there is the first stimulus in 2020 quarter 2 of 4.7 trillion dollars, then there is the second stimulus in 2021 quarter 1 of 5 trillion dollars. And finally there should be a third stimulus in quarter 3 but this chart has a data delay so it ends at quarter 2.

Ok so up till now you know how to see the increase in the money supply over time and the distributions of helicopter money over time. Let’s learn about Quantitative Easing.

So even with all this fresh new green, the Fed still opted to use their third Monetary Policy tool, quantitative easing, also known as QE for short.

What is quantitative easing?

QE means the Fed is purchasing government bonds and other financial assets. The Fed essentially injects money into the economy by buying assets. And as you may know from the laws of supply and demand, this high demand by the Fed for assets pushes the prices high. So this is a way to save the price of bonds from crashing too much.

The Fed has no upper limit to QE so up to today, it continues to purchase assets.

How much in assets has the Fed purchased over the years?

Let’s take a look at the Total Assets chart, which displays the total value of the assets of all Federal Reserve Banks as reported in the Fed’s weekly balance sheet.

In 2002, the Fed was holding 719 billions of dollars in assets. In 2008, over the span of 3 months from September to November the Fed tripled their assets to 2.1 trillion dollars. And now since March of 2020, the Fed has doubled their assets to 8.4 trillion dollars. And they are continuing QE, purchasing more assets quite linearly on a weekly basis.

Which is More Inflationary, Helicopter Money or Quantitative Easing?

The crazy thing about all these ways to pump up the money supply is that some ways are more inflationary than others. To illustrate this, let’s superimpose all the plots together and look for patterns.

So here you can see the M2 Money Stock in blue, which is basically the money supply; you can see the Assets in red, which is quantitative easing, the value of the financial assets purchased by the Fed; and lastly you can see in green are all the transfer payments from the government directly to the people, the helicopter money.

From 2006 to 2021, whenever quantitative easing has taken place, there has been a bump up in the money supply. Notably here in 2008, 2012, 2014, and 2020. Note that the amount of cash that went into the money supply was far less than released via QE. So where did the rest of the money go? A lot of that money went to the securities markets when then bonds were purchased.

Also notice that when the Fed decreased the Quantitative Easing in 2019, by selling those assets, it also took money out of the circulation.

Now take a look at the helicopter money in green, those also coincides with a bump in M2 money stock. But look at 2020, when trillions of dollars in of helicopter money was air dropped. That cash went straight into people’s savings accounts.

So quantitative easing, security purchases by the Fed, mostly goes towards inflating the securities markets. Which makes owners of those securities richer.

While the direct payments from helicopter money inflates the money supply. In other words it directly decreases your purchasing power for goods and services.

So to summarize,

which monetary policy is most inflationary, Helicopter Money or Quantitative Easing?

Helicopter money is by far one of the most inflationary methods of monetary policy because it goes directly and rapidly into people’s pockets and boosts demand in assets regardless of whether that purchase increases productivity. Helicopter money is more inflationary than quantitative easing.

Think back to when people got their stimulus checks. They were using that cash to bid up prices of bicycles and video cards. Heck if there was something you liked, now you could buy more of it.

And that is how things with fixed prices quickly went out of stock. The price wasn’t high enough. It’s the basics of supply and demand.

If you were wondering,

How inflationary are drops in interest rates?

Think of it this way. With easy credit, the bank is deciding to lend the money to someone. That person who borrowed money has to pay it back, with interest. So they need to put that money to work in a productive way that yields earnings enough to cover the interest payment and ideally makes a profit for themselves.

There will be people who don’t succeed in making a profit, like those who miss timed a speculative bubble. Others that might not even be able to pay back the loan, perhaps people who didn’t make good business decisions. And then there are people that actually put the borrowed money into productive work, and hence moved the economy.

Conclusion

Now I’d like to hear from you: how has the distribution of stimulus checks affected your life?

Let me know by dropping a quick comment below right now.

I’m Aida Yoguely. Thanks for learning with me today. And I’ll see you again in the next one. That’s all folks.

Video

Be sure to subscribe and hit the notification bell to stay tuned for the latest videos.

References

St Louis Fed M2 money stock

St Louis Fed Federal government current transfer payments to people

St Louis Fed Total Assets

- Why Helicopter Money Is Inflationary - 2021-10-09

- How Interest Rates Affect Inflation - 2021-10-08

- How Long Has Inflation Existed? - 2021-10-01